Canada-based traders can trade forex via CIRO regulated dealer members that offer forex trading, Only regulated forex brokers are safe and can legally accept traders in Canada.

In this review, we have compared the best forex brokers in Canada based on the following factors: safety, fees, trading platforms, risk management tools, and other trading conditions.

Show More

Comparison of Forex Brokers in Canada

Note: The spread and the minimum deposit is as per information on these brokers’ websites in Jun. 2022. Please see our methodology below.

Best Forex Brokers in Canada

As per our research here are the best forex brokers in Canada that we have reviewed:

- Forex.com – Overall Best Forex Broker in Canada

- CMC Markets – Regulated Forex Broker with most Currency Pairs

- AvaTrade– Canadian Broker with CIRO Regulation

- FXCM – Forex Broker with Multiple Trading Platforms

- Oanda – CIRO Regulated Broker with Low Fees for forex trading

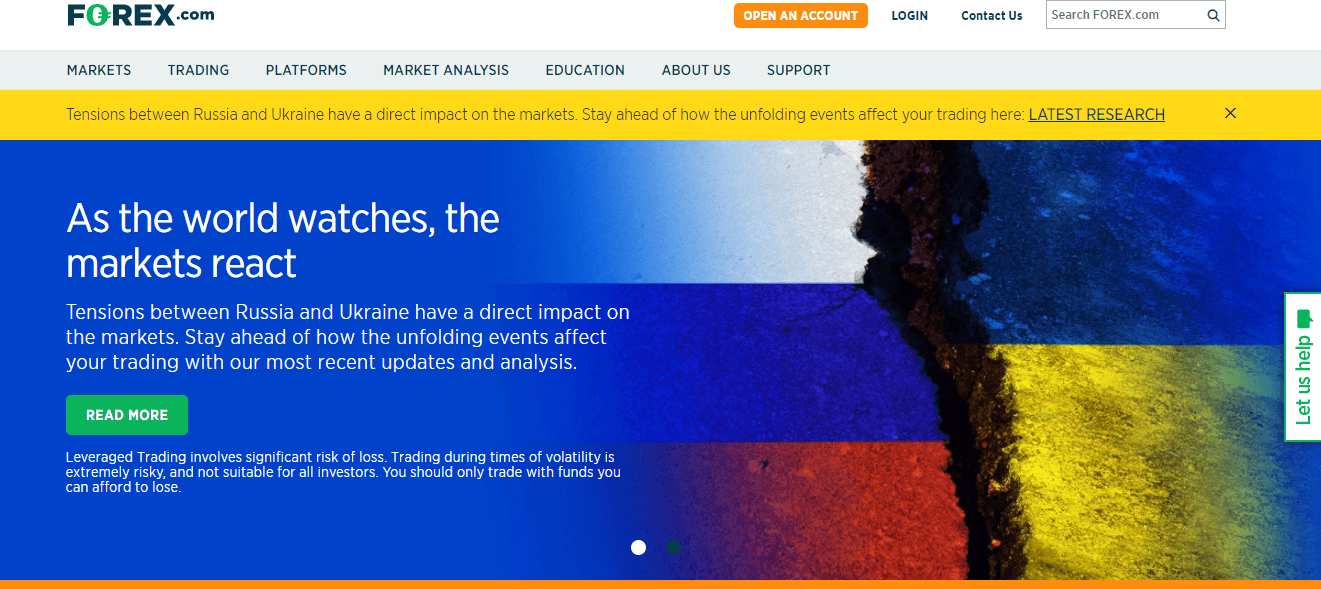

#1 Forex.com – Overall Best Forex Broker in Canada

USD/CAD Benchmark:

2.8 pips

Trading Platforms:

MT4 and Forex.com’s proprietary trading platform

Forex.com is a trading name of GAIN Capital. Forex.com Canada Limited is regulated by the CIRO. The forex broker is also a member of the Canadian Investor Protection Fund so they are considered low-risk.

Total Fees: The typical spread for major pairs is low and there is no commission for forex trading. Commissions are charged on shares CFDs. There is also an account inactivity fee of 15 CAD and no fixed fees for GSLOs. Overall, total fees are low.

Trading conditions

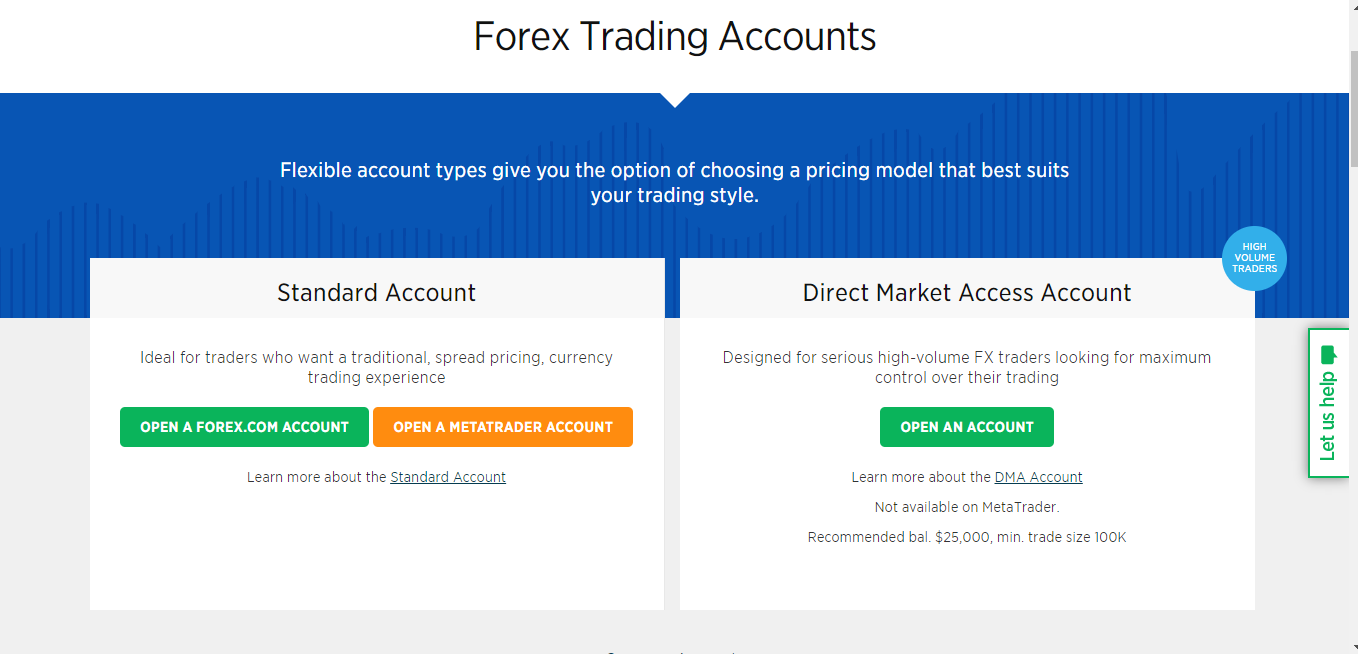

Account types: Forex.com offers Standard Account, MetaTrader 4 Account, and DMA Account. The DMA Account is for high-volume traders.

Spread for major pairs: Forex.com’s spread for major forex pairs are low.

| Major Currency Pairs |

Typical Spread (Pips) |

| EUR/USD |

1.2 |

| USD/JPY |

1.3 |

| GBP/USD |

2.0 |

| USD/CHF |

2.1 |

| USD/CAD |

2.8 |

| AUD/USD |

1.4 |

| NZD/USD |

3.3 |

Instruments: Forex.com offers 85 forex pairs, 17 indices CFDs, 1000+ shares CFDs, 11 comodity CFDs, and 10 Metal CFDs.

Leverage for forex: The maximum leverage for forex pairs is 33:1, and the leverage is lower depending on the currency pair & CFD instrument being traded with CAD Based Trading Accounts.

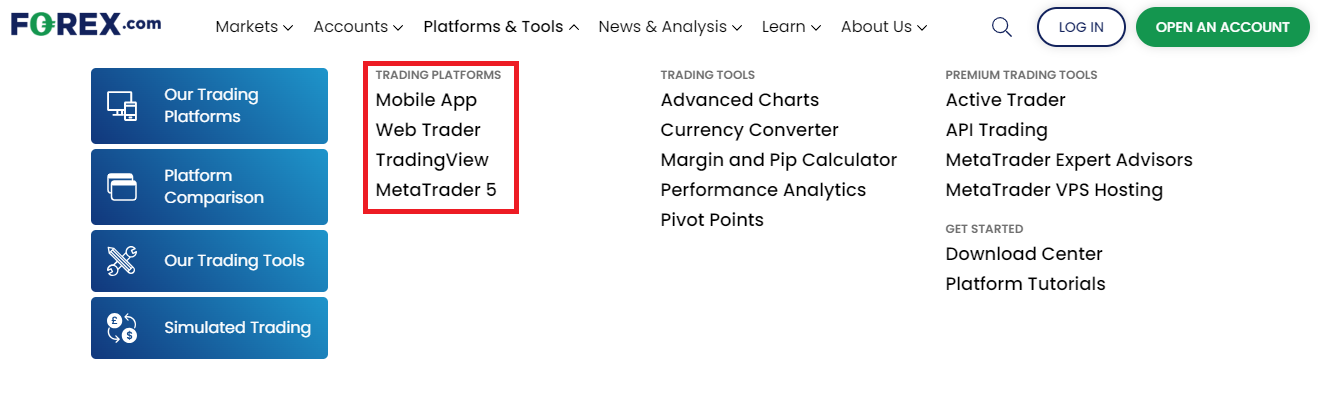

Trading Platforms: Forex.com supports MetaTrader 4. They also offer their proprietary web and mobile trading platforms.

Risk management: No negative balance protection but you can place a guaranteed stop loss.

Funding/withdrawal: You can deposit funds via credit/debit card or bank wire transfer. The minimum deposit via credit/debit cards is 100 CAD. There is no minimum deposit for bank wire transfers. You can withdraw your money via the same methods. No extra fees for deposits/withdrawals.

Customer support: Traders in Canada can get support via live chat and email. We had no holding time when we used their live chat. The response was swift. We got no response from their email support. Forex.com have good customer support.

Forex.com Pros

Read our in-depth forex.com review.

- Regulated by the CIRO

- Good customer support

- Guaranteed stop loss order

- Zero commission for forex pairs

- No deposit and withdrawal charges

Forex.com Cons

- No fixed fee for GSLOs

- No negative balance protection

- Equities are not available on their MT4 trading platform

- Limited number of Indices CFDs

#2 CMC Markets – Regulated Forex Broker with most Currency Pairs

USD/CAD Benchmark:

1.3 pips

Trading Platforms:

MT4 and CMC Markets’ Next Generation trading platform

Account Minimum:

No minimum deposit

CMC Markets are regulated by the CIRO as CMC Markets Canada Inc. In addition, they are a member of the Canadian Investor Protection Fund. CMC Markets are a low-risk forex broker because they are regulated in Canada.

Total Fees: Commissions are charged on shares CFD only and the spread for major pairs is low. There is a premium fee for GSLOs and a 15 CAD account inactivity fee. CMC Markets’ total fees are low.

Trading conditions

Account types: CMC Markets offer CFD Account and Corporate Account.

Spread for major pairs: The minimum spread for major pairs is low and shown in the table below

| Major Currency Pairs |

Minimum Spread (Pips) |

| EUR/USD |

0.7 |

| USD/JPY |

0.7 |

| GBP/USD |

0.9 |

| USD/CHF |

1.0 |

| USD/CAD |

1.3 |

| AUD/USD |

0.7 |

| NZD/USD |

1.5 |

Instruments: The following CFDs are available: 330+ forex pairs, 90+indices, 9400 shares and ETFs CFDs, 110+ commodities, and 50+ treasuries

Leverage for forex: Live details on leverage can be found on their trading platform.

Trading Platforms: CMC Markets offer MT4 and their Next Generation trading platform. The latter is available on the web, desktop, and mobile phones.

Risk management: Guaranteed stop-loss order is available. However, you can lose more than your initial deposit.

Funding/withdrawal: You can fund your account via online bill payment, EFT, bank transfer, and personal cheque. You incur a 15 CAD fee if you deposit via bank transfer. Withdrawal is possible through EFT and bank transfer only. No extra fees for withdrawals.

Customer support: You can get support via their mobile number and email. We tested their email support and got no response. Our customer support experience was not good.

Read our CMC Markets review for more on this broker.

CMC Markets Pros

- Regulated by the CIRO

- No minimum deposit

- Guaranteed stop loss order

- Zero commission for forex pairs

- Wide range of CFD products

CMC Markets Cons

- Deposit charges

- No negative balance protection

- Inactivity fee

- Commission on shares and ETFs CFDs

- Their MT4 is not web-based

#3 AvaTrade – Canadian Broker with CIRO Regulation

USD/CAD Benchmark:

1.5 pips

Trading Platforms:

Metatrader 4, Metatrader 5, and AvaOptions

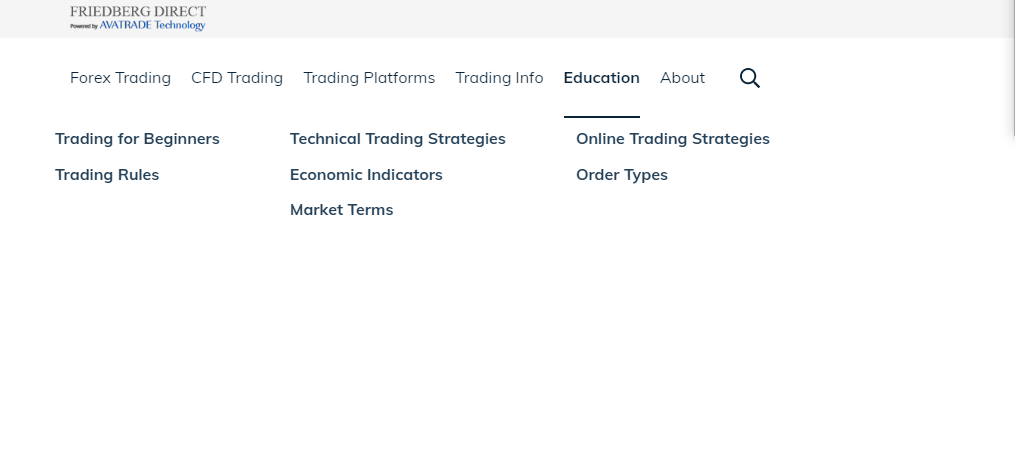

Forex traders in Canada can open a trading account with Friedberg Direct, which clears trades through a subsidiary within the AvaTrade group. Friedberg Direct is a division of the Friedberg Mercantile Group Ltd and are regulated by the CIRO.

Total Fees: Spread for major pairs are low and no commission is charged for forex pairs. The inactivity fee is 50 CAD after three months of account inactivity. If inactivity extends for 12 months, the fee is 100 CAD. Total fees are high.

Trading conditions

Account type: The forex broker offers just one trading account

Spread for major pairs: Here is AvaTrade’s spread for major pairs

| Major Currency Pairs |

Typical Spread (Pips) |

| EUR/USD |

0.6 |

| USD/JPY |

0.7 |

| GBP/USD |

1.0 |

| USD/CHF |

1.0 |

| USD/CAD |

1.5 |

| AUD/USD |

0.8 |

| NZD/USD |

1.5 |

Instruments: AvaTrade offers 47 currency pairs, 589 stocks CFDs, 18 commodity CFDs, 42 options CFDs, 17 indices CFDs, and 2 Bonds CFDs

Leverage for forex: Retail traders can access leverage of up to 33:1

Trading Platforms: Metatrader 4, Metatrader 5, and AvaOptions are available. AvaOptions is for options trading only.

Risk management: Stop loss is not guaranteed but there is negative balance protection.

Funding/withdrawal: Funding and withdrawal is easy and convenient. Two funding/withdrawal methods are available: credit/debit card and bank wire transfer. There are no extra deposit/withdrawal fees by AvaTrade.

Customer support: We had a good customer support experience with AvaTrade. We had about three minutes of holding time with their live chat. But no response was received from their email support even after 24 hours during our initial test for this review.

Read our AvaTrade review for more on this broker.

AvaTrade Pros

- Good Live chat customer support

- Negative balance protection is available

- No deposit/withdrawal charges for traders in Canada

- Zero commission for forex pairs, and the only fees they charge is the spread

AvaTrade Cons

- No guaranteed stop loss orders on their platform

- Minimum deposit is 300 CAD, which is higher than other brokers

- Inactivity fee is up to 150 CAD

- Number of CFDs is limited

#4 FXCM – Forex Broker with multiple Trading Platforms

USD/CAD Benchmark:

0.5 pips, $14 commission per standard lot

Trading Platforms:

FXCM’s Trading Station and Metatrader 4

Canada-based traders can access FXCM’s CFDs products by opening an account with Friedberg Direct. Friedberg Direct’s parent company is regulated with the CIRO so FXCM is considered low-risk.

Total Fees: FXCM charges commissions for forex pairs but the spread for major pairs is low. In addition, you are charged 50 CAD for account inactivity fee. Overall, total fees are low.

Trading conditions

Account type: Only one trading account is available.

Spread for major pairs: The typical spread for major pairs is displayed in the table below

| Major Currency Pairs |

Typical Spread (Pips) |

| EUR/USD |

0.2 |

| USD/JPY |

0.3 |

| GBP/USD |

0.6 |

| USD/CHF |

0.6 |

| USD/CAD |

1.5 |

| AUD/USD |

0.3 |

| NZD/USD |

0.5 |

Instruments: 41 currency pairs, 13 indices CFDs, and 9 commodity CFDs are available.

Leverage for forex: You will find the leverage for forex on their trading platform.

Trading Platforms: FXCM offers their proprietary Trading Station and Metatrader 4

Risk management: No guaranteed stop loss order or negative balance protection.

Funding/withdrawal: Forex traders in Canada can deposit/withdraw funds via credit/debit card and bank wire transfer. No extra charges by FXCM.

Customer support: You can get support via fax, email, calls, WhatsApp, and live web chat. We had 5 minutes of holding time when we spoke with their live chat support. We got no response from their email support.

FXCM Pros

- Low spread for major pairs

- Good customer support

- No deposit/withdrawal charges

- Minimum deposit is 50 CAD

FXCM Cons

- Extra commission per lot

- Inactivity fee

- Limited CFD products range

#5 Oanda – CIRO Regulated Forex Broker with Low Fees

USD/CAD Benchmark:

1.6 pips

Trading Platforms:

Oanda Trade, Metatrader 4, and TradingView

Account Minimum:

No minimum deposit (standard account only)

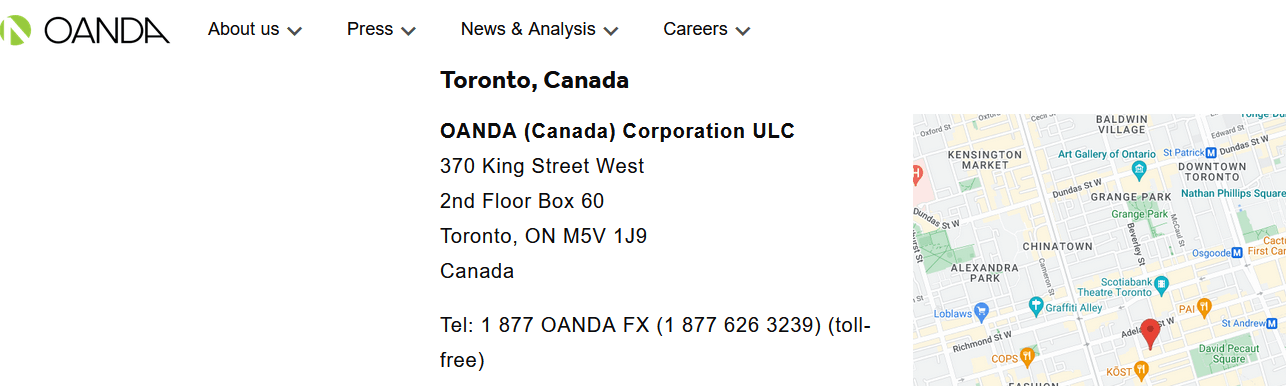

OANDA is regulated with the CIRO as OANDA (Canada) Corporation ULC. The Canadian Investor Protection Fund protects their customer accounts so they are considered low-risk.

Total Fees: No commissions with low spread for major currency pairs. Account inactivity fee is 10 CAD. OANDA’s total fees are low.

Trading conditions

Account type: OANDA offers Standard and Premium Accounts

Spread for major pairs:

| Major Currency Pairs |

Typical Spread (Pips) |

| EUR/USD |

1.5 |

| USD/JPY |

1.9 |

| GBP/USD |

1.8 |

| USD/CHF |

1.5 |

| USD/CAD |

1.6 |

| AUD/USD |

1.3 |

| NZD/USD |

1.9 |

Instruments: 69 currency pairs, 19 indices CFDs, 23 metal CFDs, 6 commodities CFDs, and 5 bonds CFDs are available.

Leverage for forex: OANDA offers a maximum leverage of 50:1 for major currency pairs

Trading Platforms: Oanda Trade, Metatrader 4, and TradingView are the trading platforms that are available.

Risk management: OANDA does not offer GSLOs and negative balance protection to traders in Canada.

Funding/withdrawal: Deposit/withdrawal is easy. Available methods are PayPal and bank wire transfer. There are no extra fees for deposits but you are charged for bank transfer withdrawals.

Customer Support: Overall, customer support is good. We had 4 minutes holding time on their live chat support.

OANDA Pros

- No minimum deposit

- Regulated by the CIRO

- No commissions for forex

- Easy deposit/withdrawal

- Multiple trading platfroms

OANDA Cons

- Number of CFDs is limited

- Inactivity fee

- No guaranteed stop loss orders

- Your account can enter negative balance

What is a Forex Broker?

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell). Through a forex broker, your profit or loss from trading CFDs is cash settled in a brokerage account you have opened with the broker.

A forex broker could be a market maker which means they could be taking the opposite sides of your trades or a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

How to Choose the Best Forex Broker in Canada

Choosing the best forex broker is a subjective matter, however, there are general factors you should consider before choosing one.

Here are some of the factors that we have considered for this review in our methodology:

1. Safety of Deposited Funds

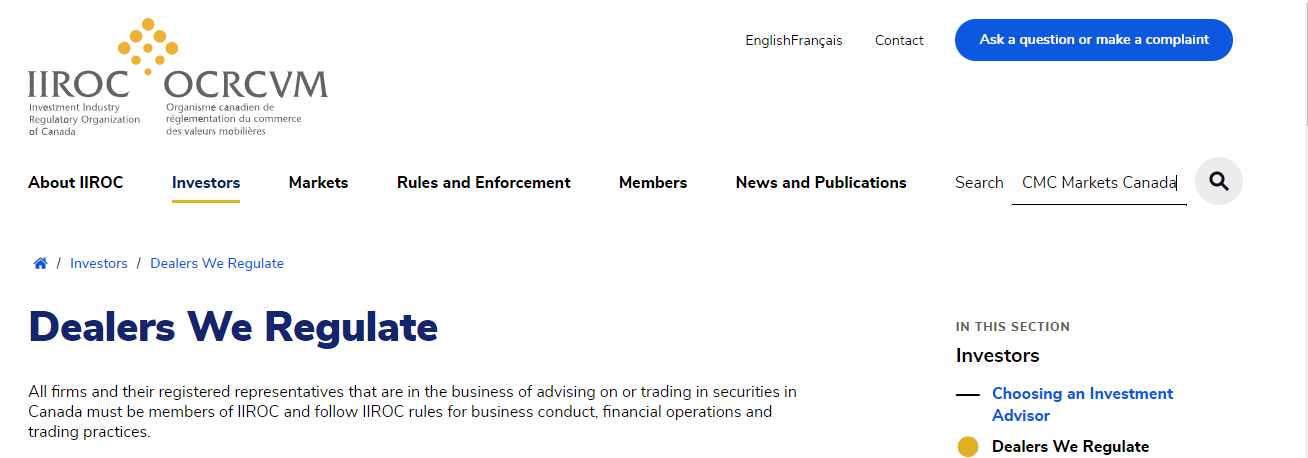

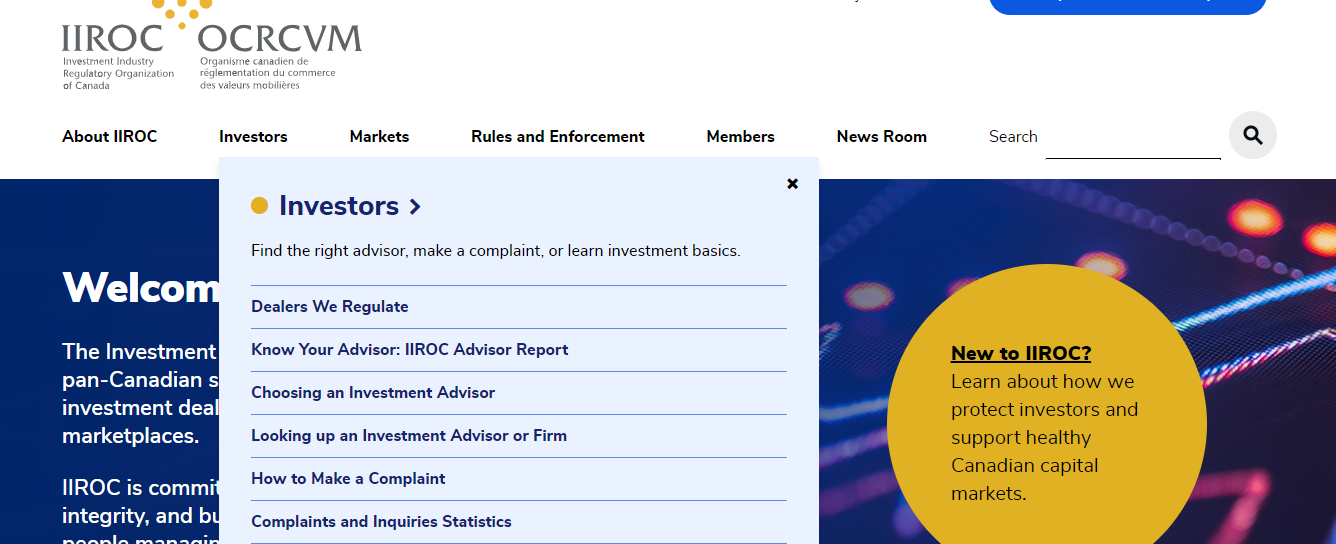

The CIRO regulates the forex & CFD brokers in Canada.

You should only choose forex brokers that are regulated by them. In addition, your preferred broker should also be a member of the Canadian Investor Protection Funds. Otherwise, you would not get protection on your deposited funds.

Make sure that you fully verify a CFD broker’s regulation before signing up with them. This will help you stay away from unregulated & fake CFD brokers.

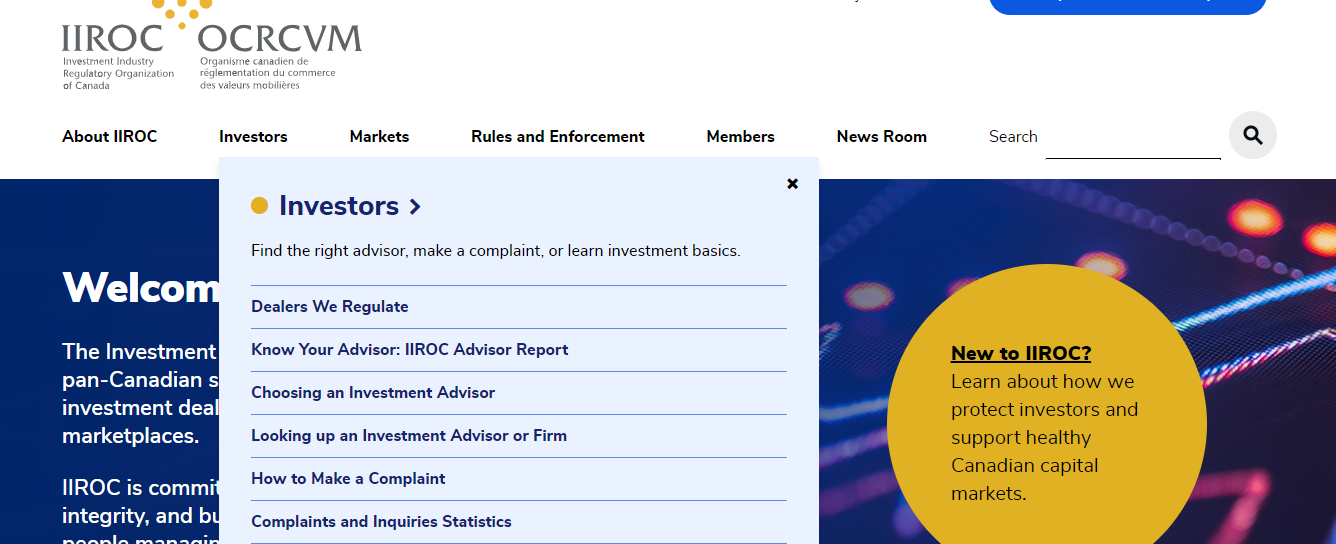

Some fake brokers may also claim they are regulated by using the license of actual regulated brokers. One way to avoid such scam brokers is by verifying the license no. on CIRO’s website, and matching if the website that you are visiting is the actual website listed on CIRO’s portal.

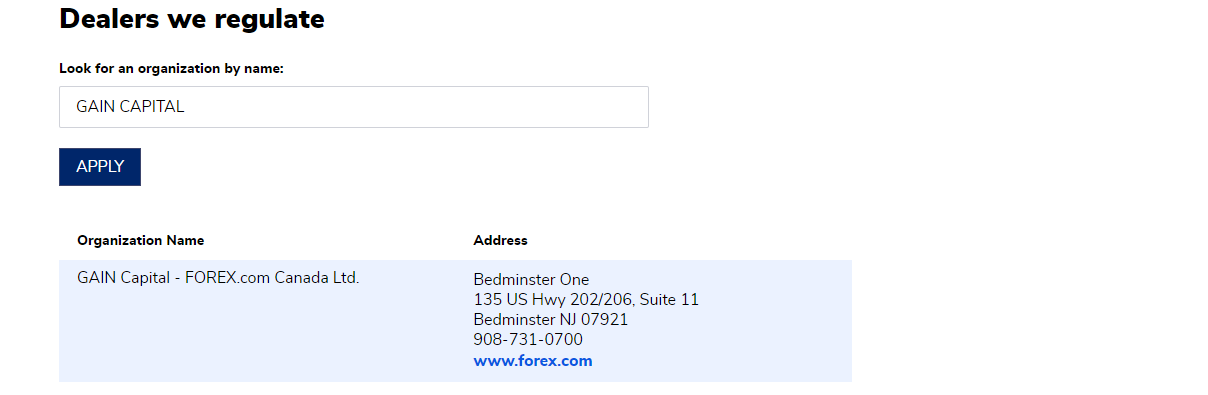

We cover how you can verify this in another section of this review. We’ll use forex.com as our example

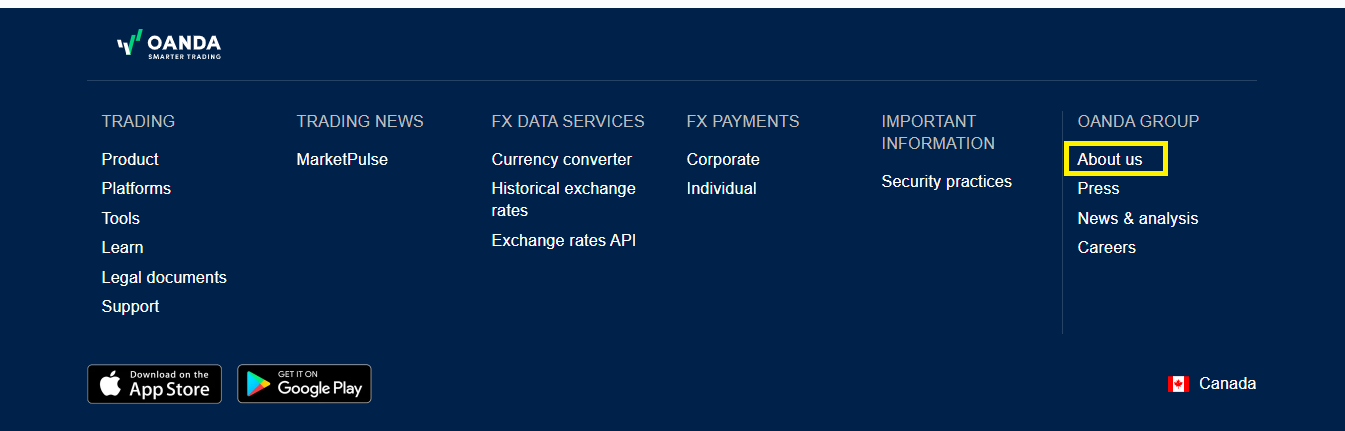

First, go to the broker’s website and confirm if they are regulated with the CIRO. It is usually at the footer of their website.

From the image, you can see that forex.com is regulated by the CIRO and is a member of the Canadian Investor Protection Fund. In addition, you can see that forex.com is the trading name. The broker is actually a subsidiary of GAIN Capital. These are the details to look out for on the IIROC’s website.

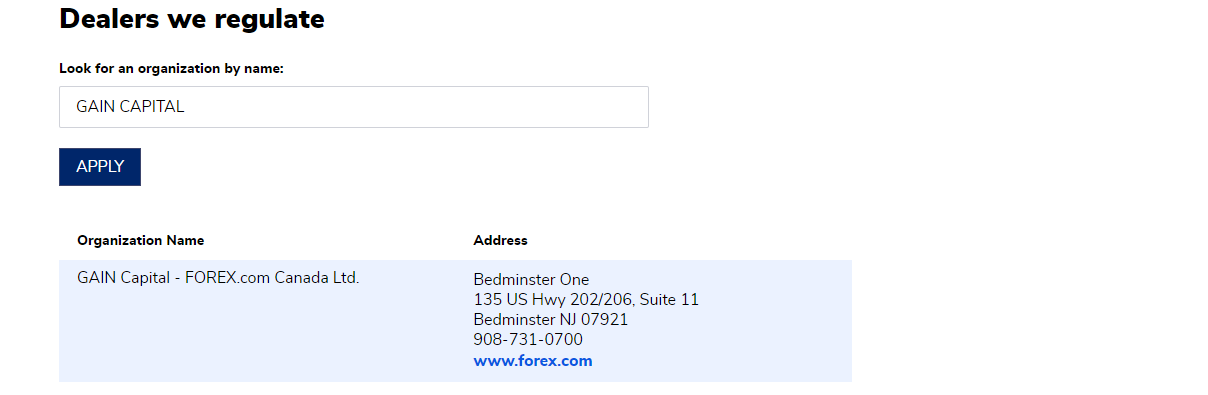

In the search bar, enter the broker’s name. As you can see, we entered GAIN CAPITAL. After this, click ‘APPLY’. You will get the result displayed below

You can repeat these steps for any CIRO regulated broker and verify their regulation.

Another way to know if a forex broker is low-risk is to check if they are licensed with top-tier regulatory bodies. Forex brokers in Canada have the local CIRO regulation. However, there are other top licenses that make a broker reputable.

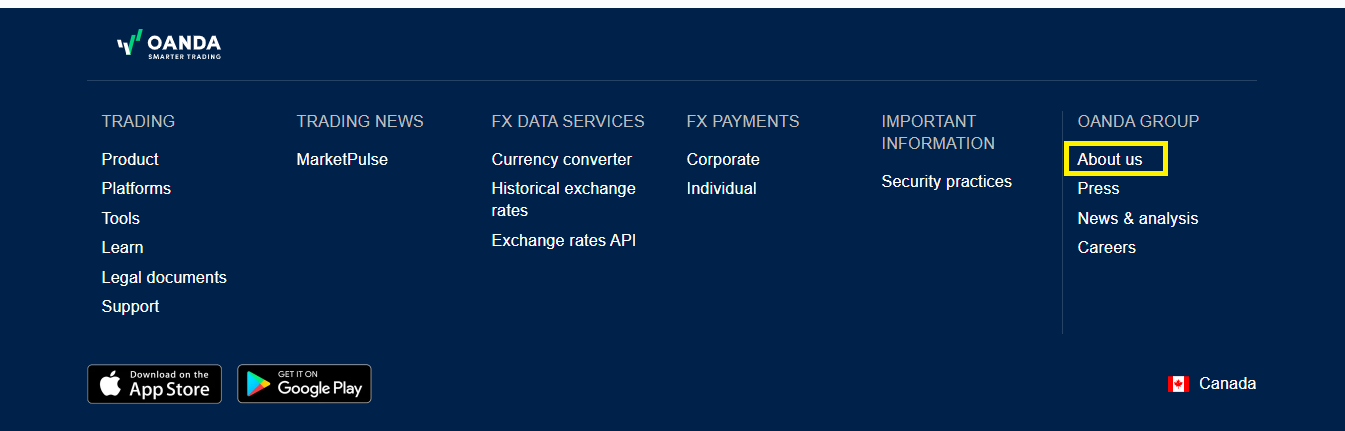

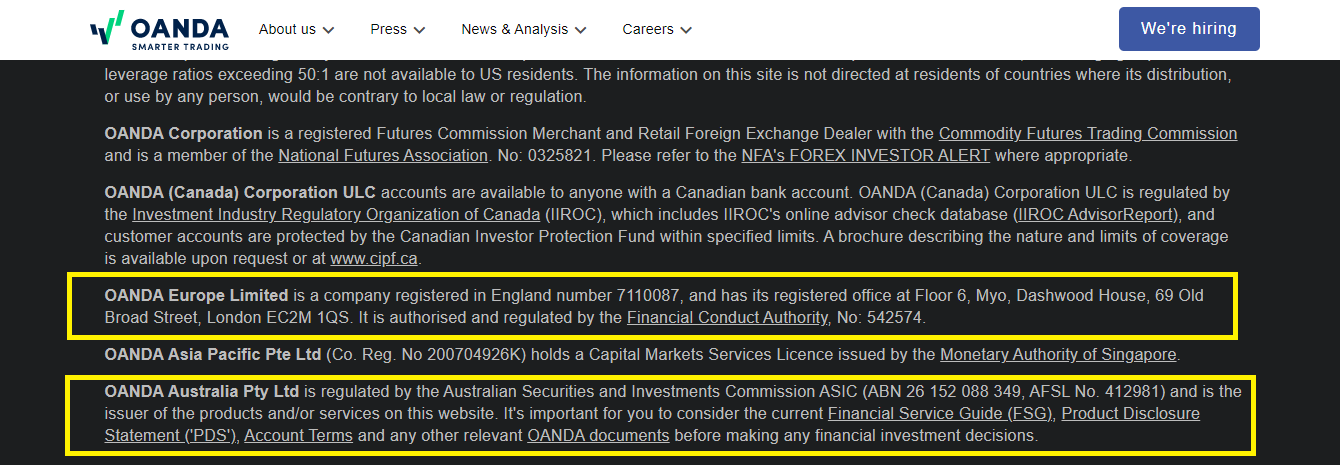

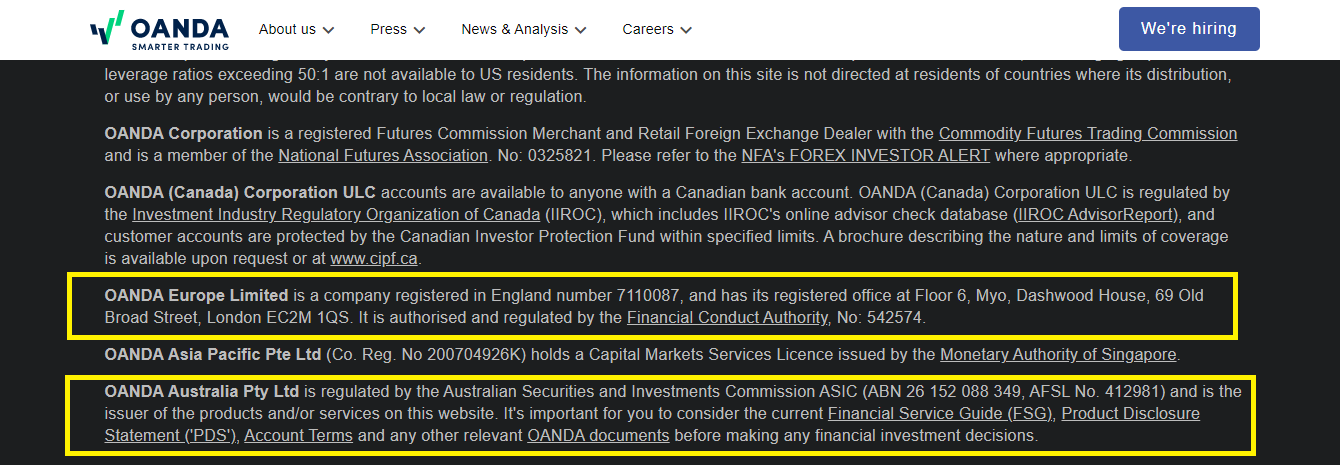

These bodies include the FCA (UK) and ASIC (Australia). You can also consider CySEC (Cyprus). If your broker is regulated with CIRO plus one or more of these regulatory entities, the risk of fraud is lower. OANDA is an example of such a broker in Canada. Here is how you can confirm this.

On OANDA’s Canadian website, click ‘About us’

You will be taken to a page that contains more information about OANDA Group. If you scroll down the page, you will find all of OANDA’s regulations. Here is how it looks.

From the image, you can see that OANDA is regulated with the FCA as OANDA Europe Limited. They are also regulated with ASIC as OANDA Australia Pty Ltd. With these two regulations, you can be sure that a forex broker is low-risk.

If you do not want to research yourself, the easiest way to find this out is to speak to your broker’s customer support.

2. Overall Fees

Overall fees (trading and non-trading fees) should be low. Overall fees determine your final profit or loss, so make sure to check them. Here is a guide on how to check with forex.com

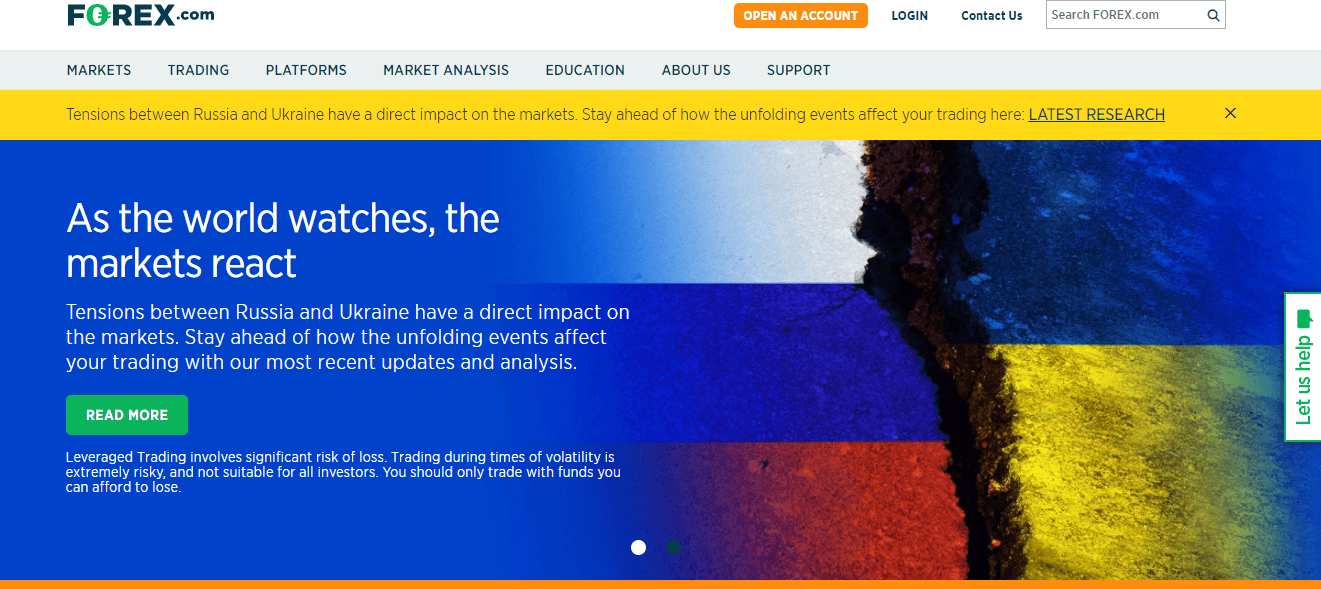

Forex.com’s home page is displayed below

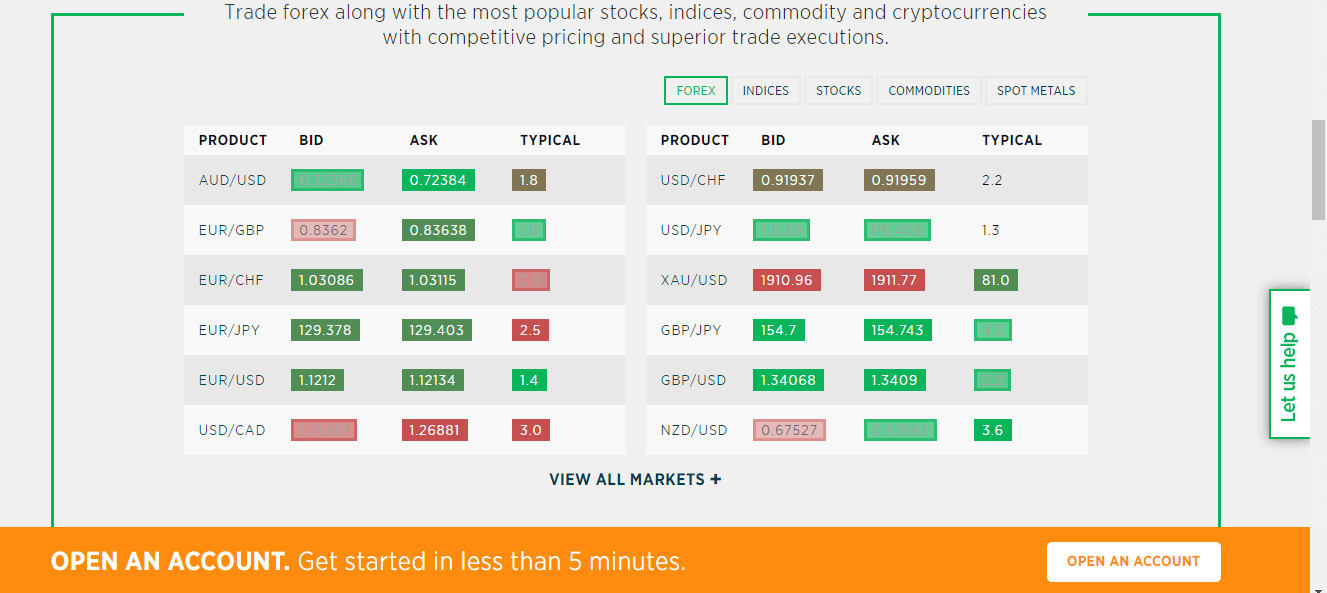

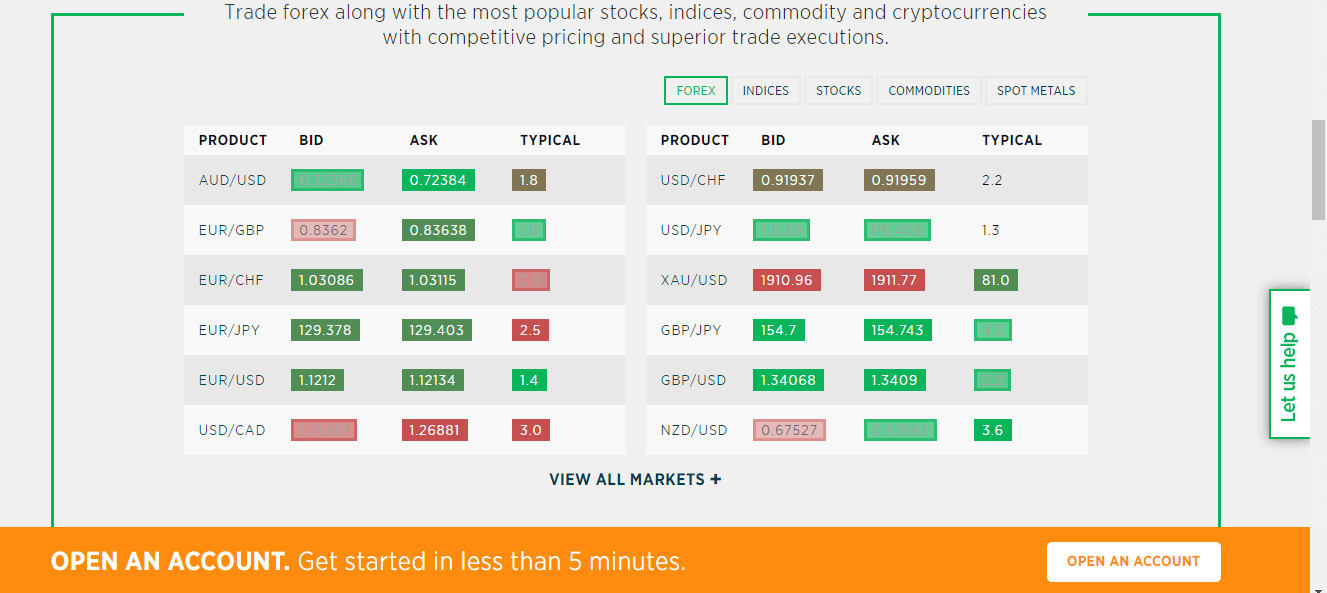

Click on markets, you will see a drop down. Then click on pricing and fees. You will find the spread for some currency pairs as shown below

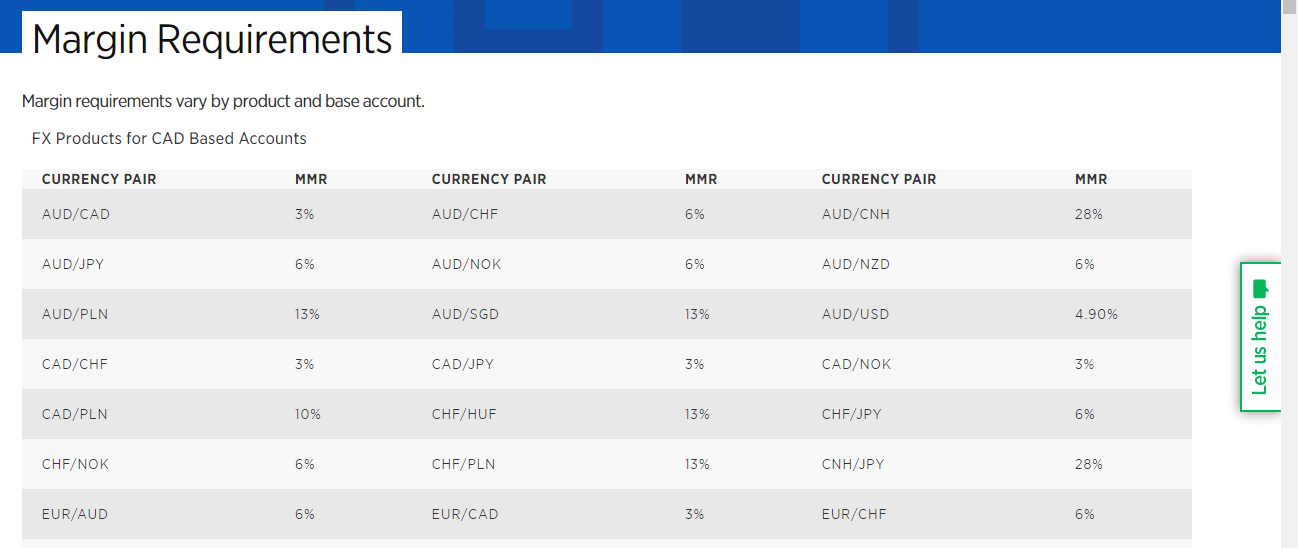

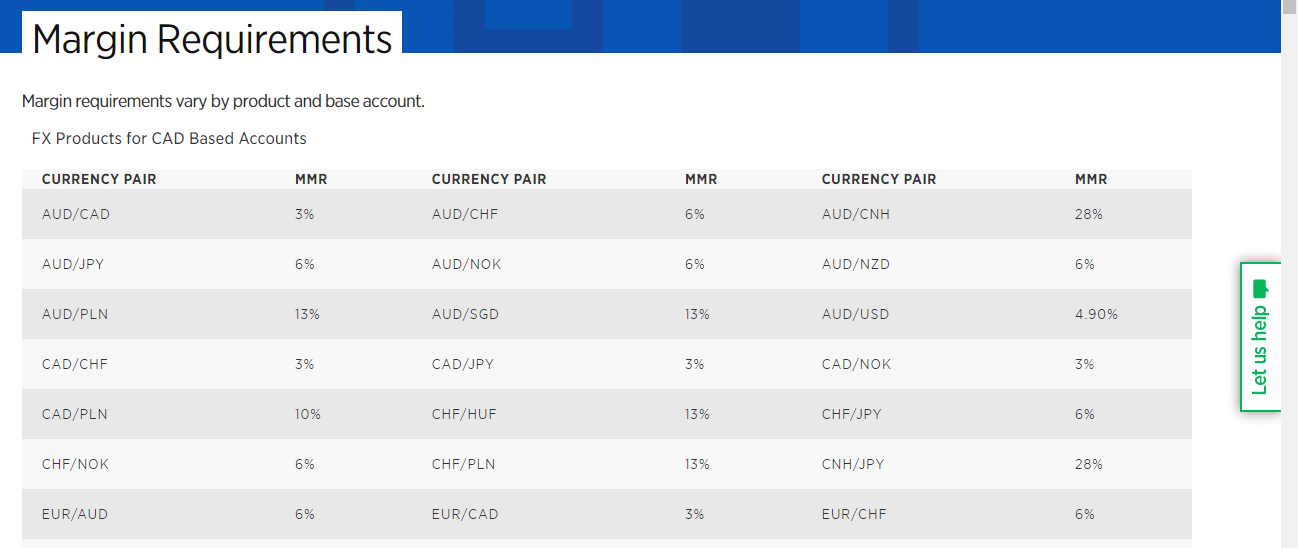

In addition, you can find the margins as well if you scroll further down. To find out more about fees, you can use the live chat function on the right side of the picture below.

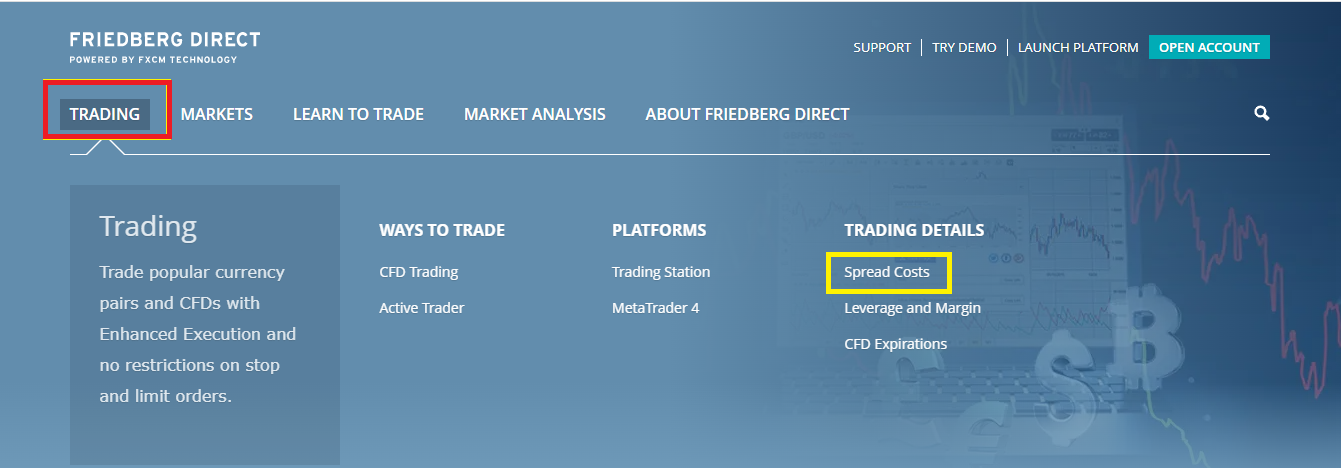

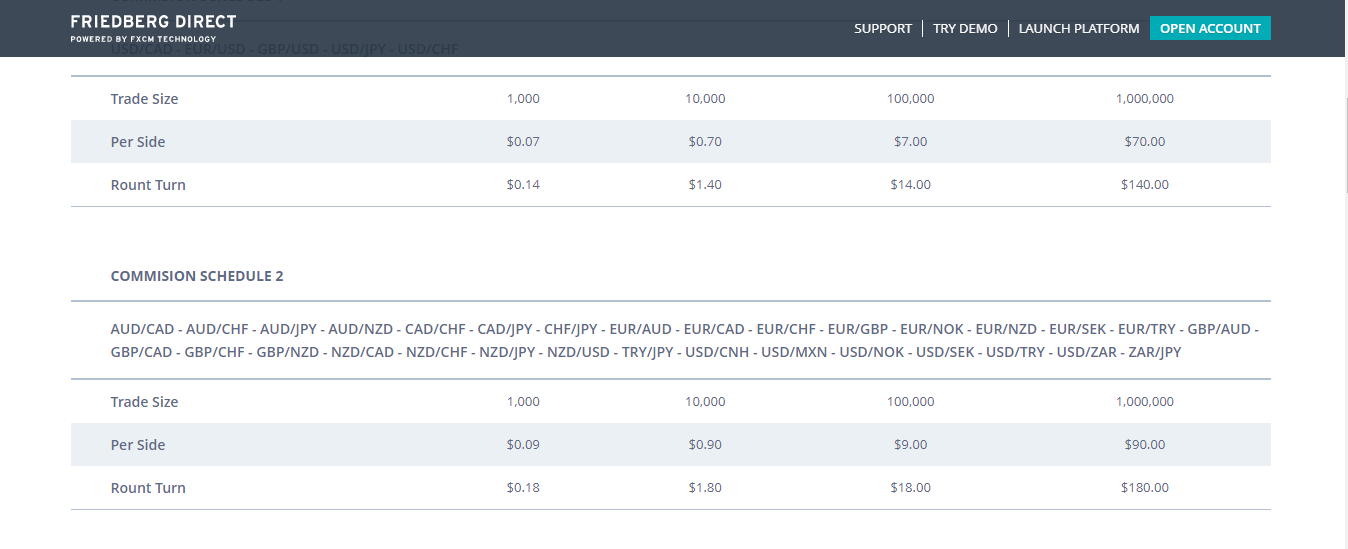

Swaps and commissions are also part of your trading fees. Some forex brokers have their swaps on their trading platforms while some state the rollover costs on their websites. However, commissions are usually stated. We will use FXCM as an example of how to check for commissions.

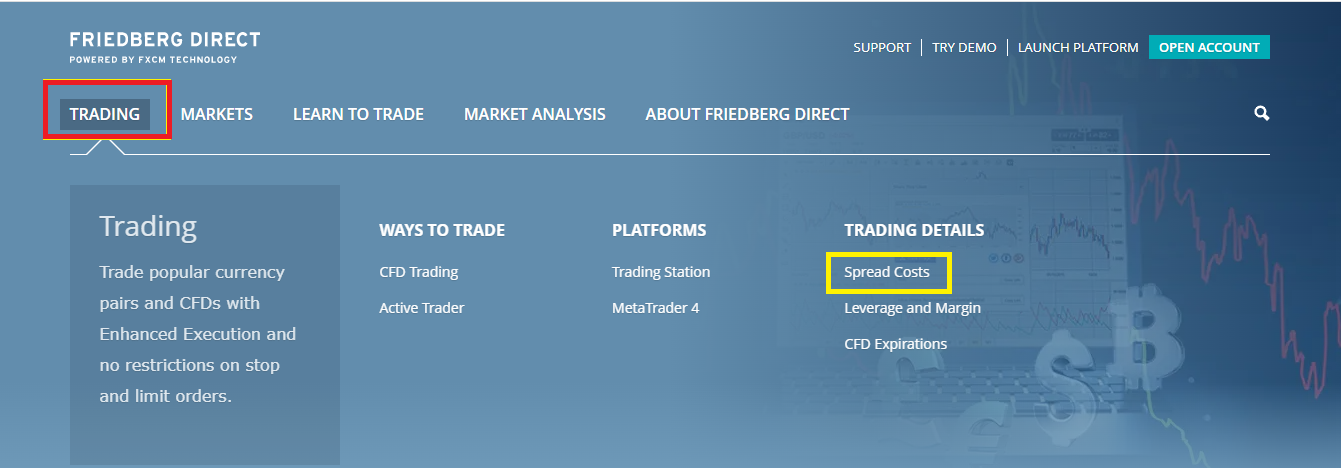

First, go to their website at fxcm.com/ca. On the homepage, click on ‘Trading’ (in the red box). A drop down of with different options will show up as shown below. Then you can click on ‘Spread Costs’ (in the yellow box)

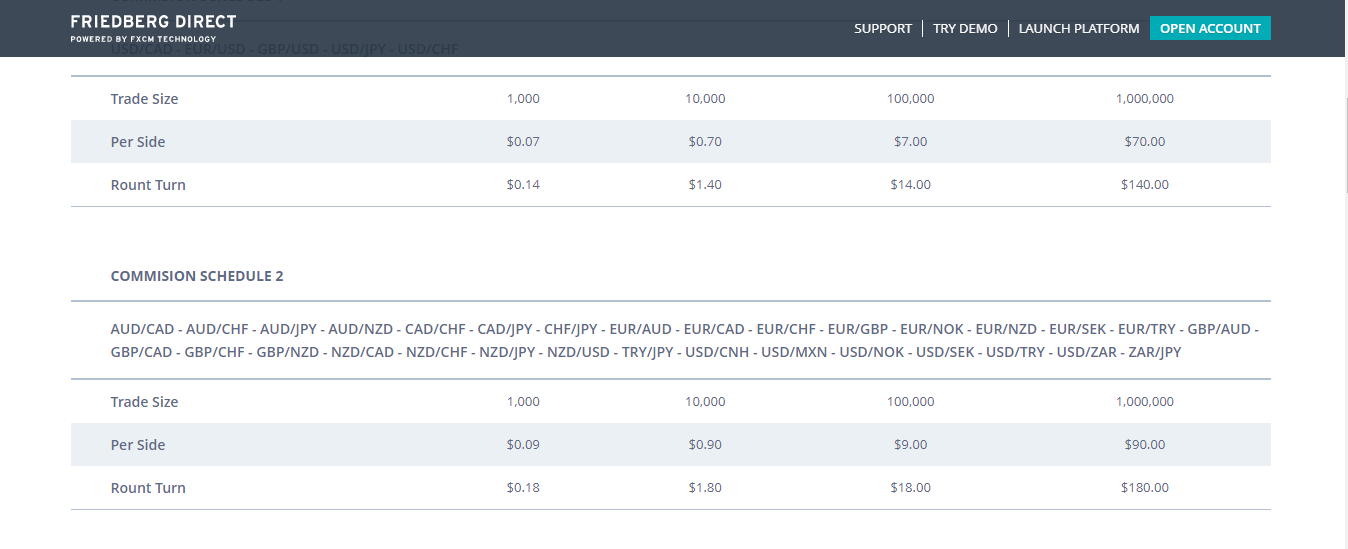

When you click on spread costs, you will find the commissions on the page that comes up as displayed below.

As you can see, there are different commission schedules for different currency pairs. You should get familiar with this to know the pairs with high commissions.

3. Range of Trading Instruments

Your forex & CFD broker should offer you a wide range of CFD products. This must include a range of currency pairs, CFDs on indices, shares, commodities, metals, and energies. You should look out for these basic CFD instruments.

You must first check if your desired currency pair or CFD instrument is available at the broker or not. Let’s see how you can check that.

For example, let’s say you want to trade USD/CAD currency pair. Then you must check this under the forex broker’s range of instruments. Since in this example, USD/CAD is a forex pair, so you must check forex trading instruments.

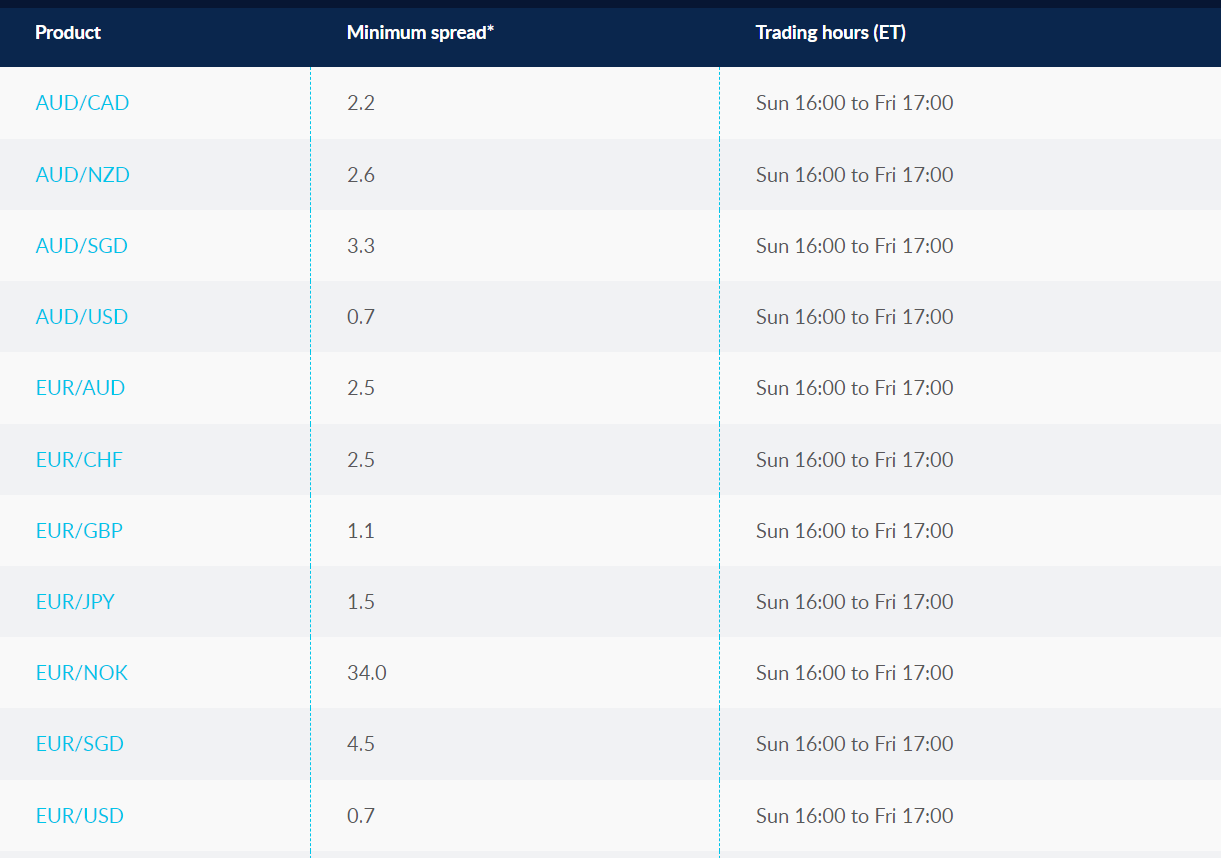

Let’s see an example of CMC Markets.

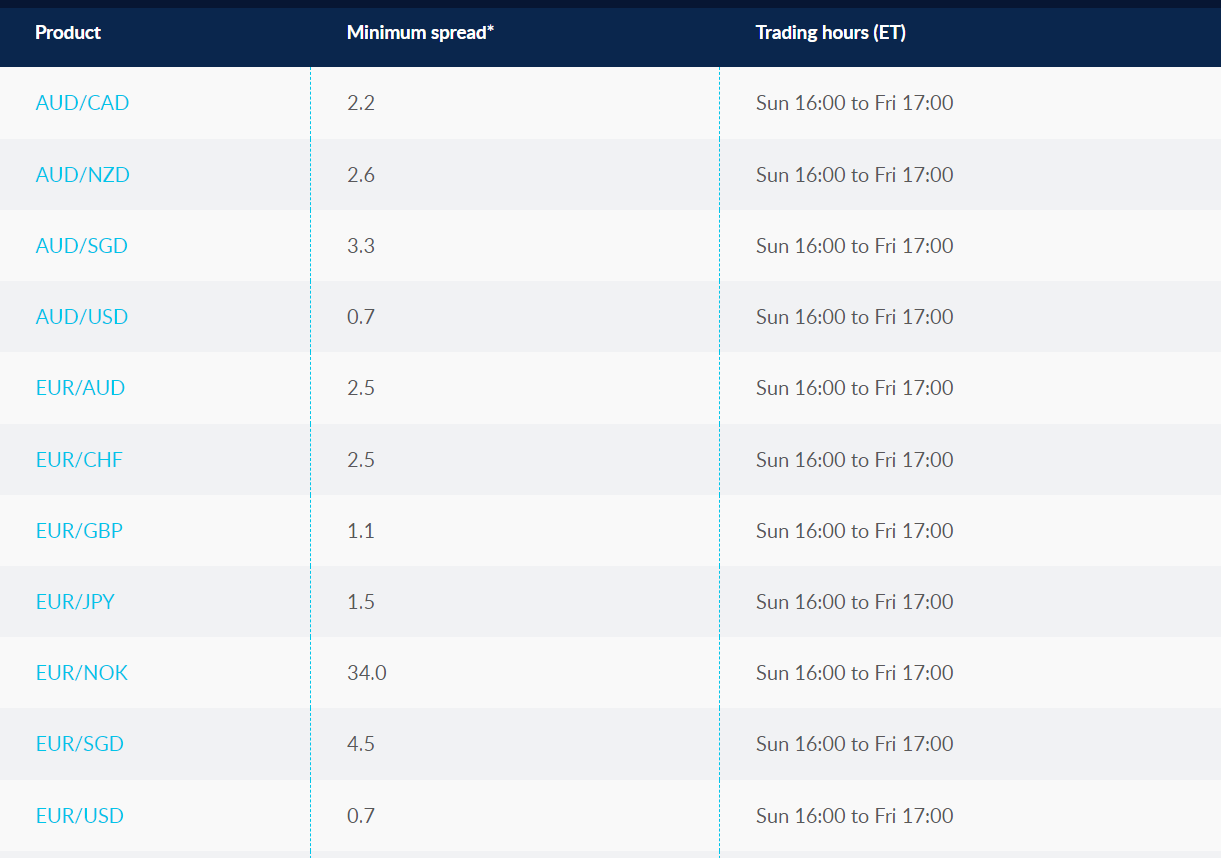

They list all their currency pairs available for trading under their ‘forex trading’ page on their website. If you scroll down on that page, you will see a table like the screenshot below.

In the table, you will be able to check the currency pairs, minimum spread, and trading hours. Similar to the above screenshot, you can check the available instruments on the website of other forex brokers.

If you are not sure, then you can talk to the chat support on the forex broker’s website & ask them to provide you the ‘URL/link’ of the page to view the details of all the available ‘CFD products & instruments’

4. Account types

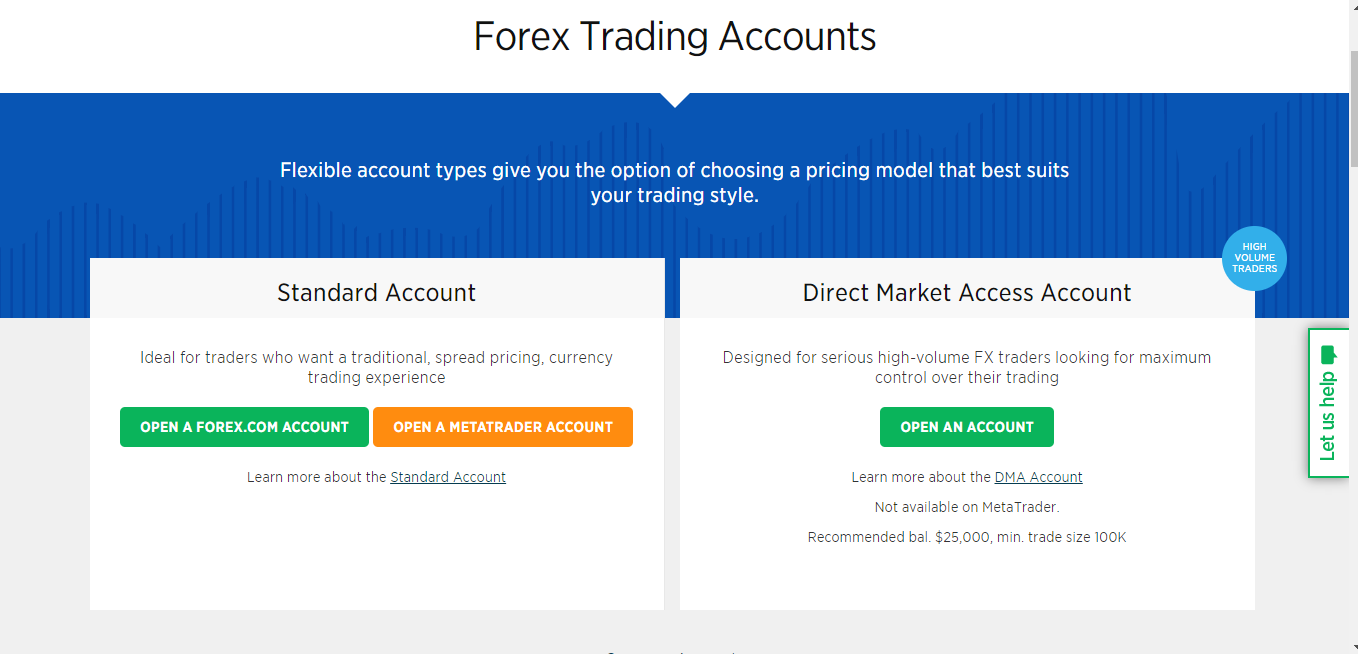

Typically, forex brokers have more than one account. The accounts have different fees and leverage structures which allows for flexibility. First, there are accounts based on your client category. You could be a retail client or a professional client. Retail accounts differ from professional accounts by leverage and requirements.

In Canada, forex brokers have different accounts. There are usually Standard Accounts with standard fee structures, generally as spreads and swaps. In addition to this, they are other accounts that can be based on platforms. For example, forex.com have a MetaTrader account.

From the image, you can also see there is a Direct Market Access (DMA) Account. This falls under accounts designed for traders that transact in high volumes (typical of Professional traders). Some brokers just refer to such accounts as Pro Accounts.

As you sign up with your broker, all you need to do is select the account you want. However, you should know there are brokers with one account only. If you choose that kind of broker, you don’t get to make a choice.

5. Deposit/Withdrawal Options

Two things are important here, First is the deposit/withdrawal time and extra charges. You want to choose a broker with a short payment processing time and little to no charges. These depend on the broker you choose and the deposit/withdrawal options they support. This is why it is important for you to check.

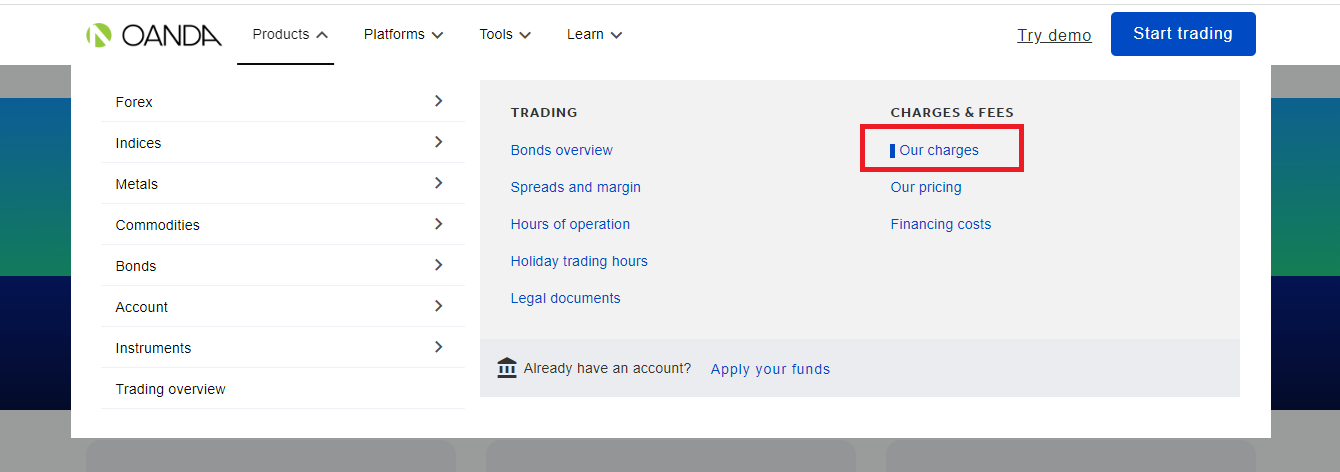

Deposits should be instant while withdrawals should take 1-3 days ideally. You should also be able to deposit through local banks. Here is how you can check deposit/withdrawal options. We will use OANDA as our example. If you to their homepage and you click on ‘Our Charges’, you will find all the info you need.

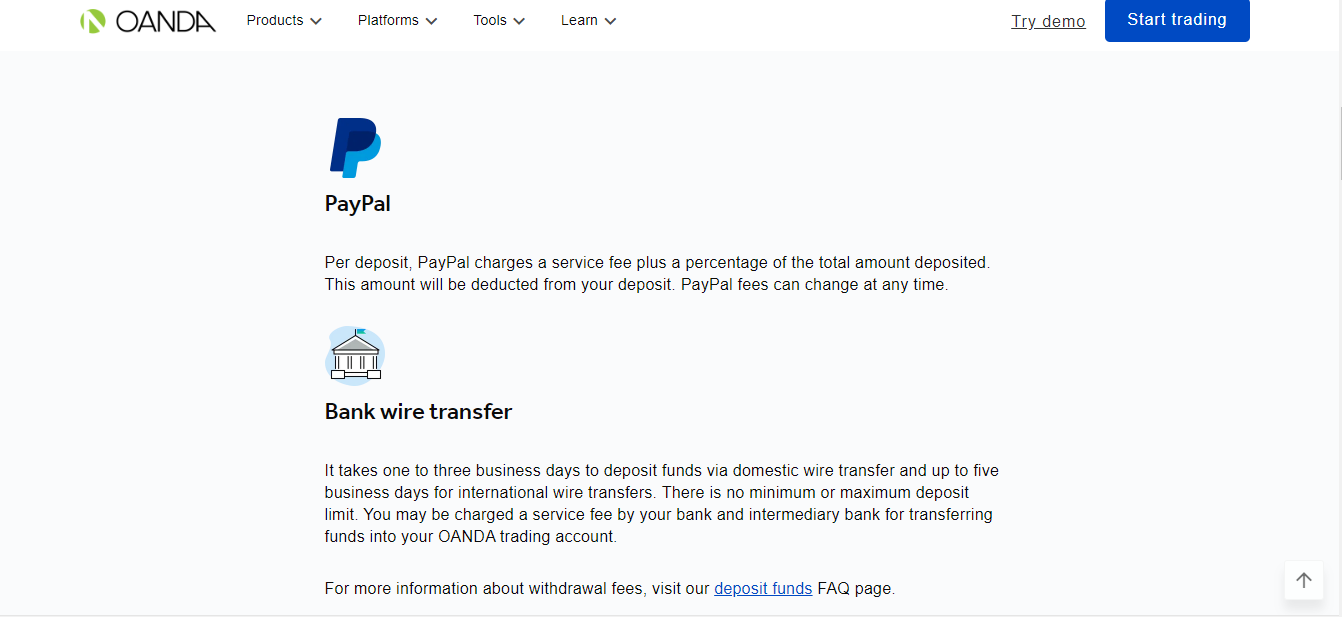

The info contains the deposit/withdrawal methods, charges, and processing time.

From the image, you deduce that OANDA charges no fees for deposits. Any charges incurred are from the payment provider or your bank. You can also see it takes 1-3 business days to process funding via bank transfer. If you scroll further down, you will see how it is for withdrawals.

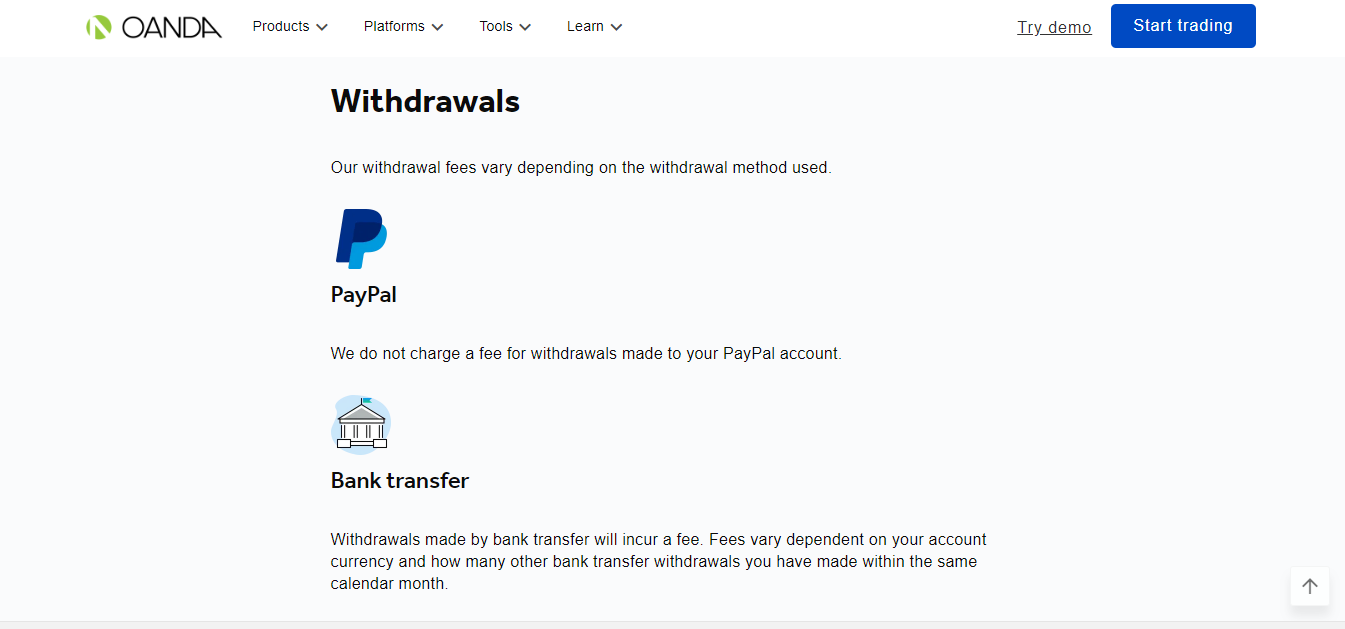

You can see from the image that Onada charges no fees for withdrawals via PayPal. However, withdrawals via bank transfer attract charges depending on certain conditions.

6. Broker’s Support

Your broker should be reachable via different means.

Emails, live chat, and phone numbers should be found on their website, and also available to non-logged-in users. In addition, the broker should give a quick and helpful response to your inquiries.

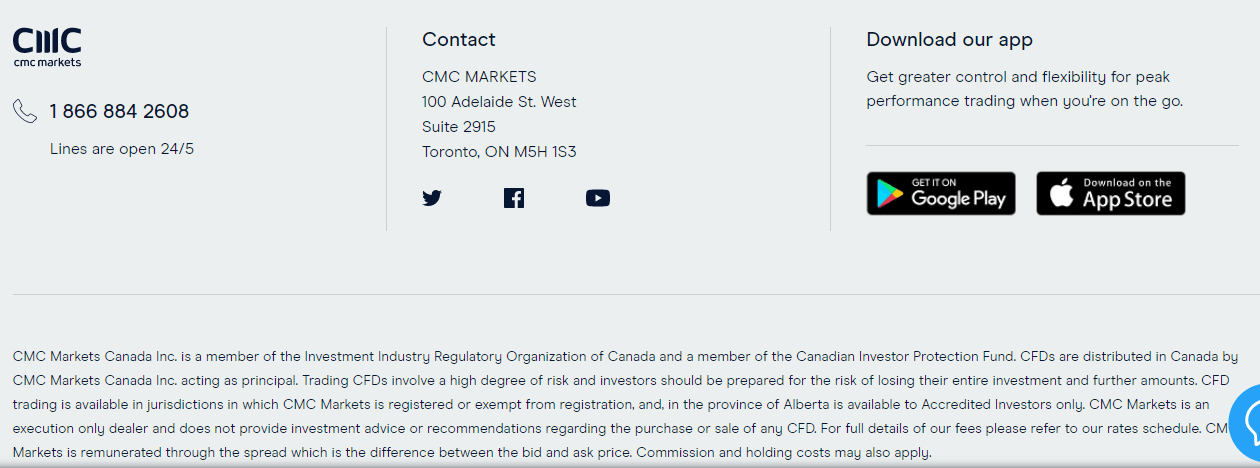

It is important that the phone number of the broker’s website is a local contact in Canada. If the broker has local support options, then we consider it a positive point.

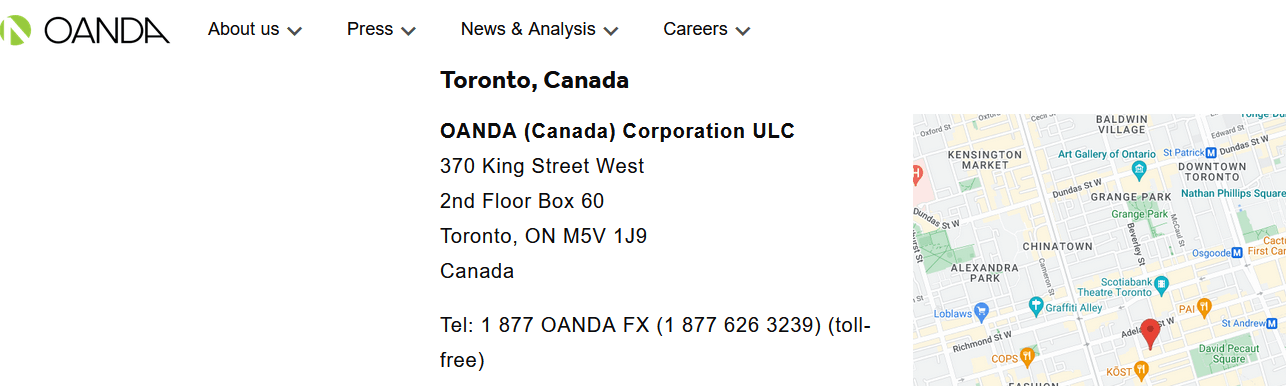

You should search for the ‘contact’, ‘about’, or similar pages on the broker’s website. Sometimes, you will not find these pages, but there will be other pages like ‘Our Offices’ in the case of Oanda.

We found the following details on Oanda Canada’s website.

From the above, and by calling the phone number, you can verify that the broker actually does have a local contact number in Canada.

All the CIRO regulated forex brokers will generally publicly list their contact numbers & address on their websites. You can easily verify that by following the steps explained above.

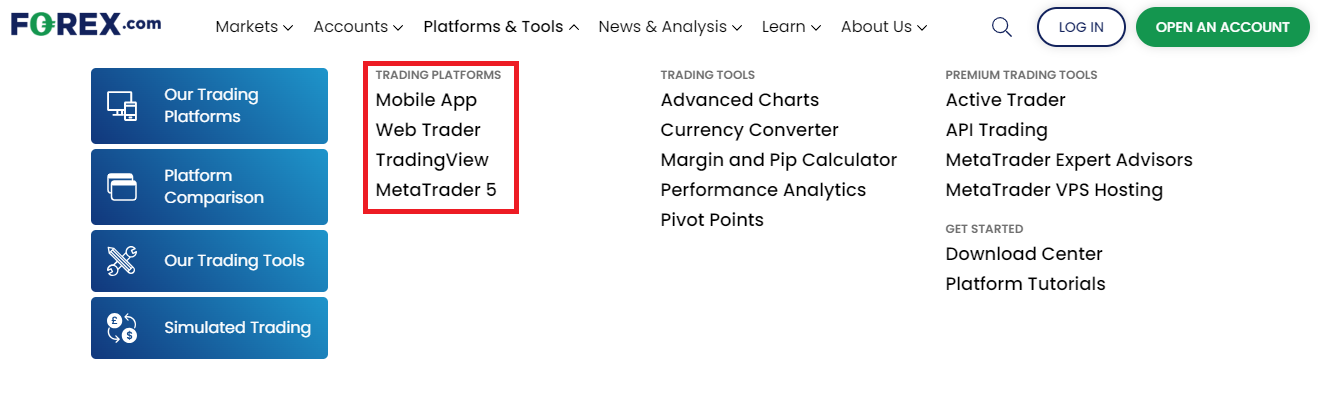

7. Choice of Trading Platforms

Metatrader 4 (MT4) and Metatrader 5 (MT5) are the most popular trading platforms. Not all brokers have them though. What you want to pay attention to here are platform-specific features.

Some brokers have more instruments on their MT4 platform than MT5. There could even be differences in swaps and commissions across the two platforms. So make sure to look this up on the broker’s website. In addition, the platforms should be multi-device. Mobile trading apps are handy for on-the-go trading. Desktop versions/web traders give you a better view of the price.

You will need to combine these devices for effective trading so make sure you check. Here is how we checked with Forex.com for example. On their homepage, click ‘PLATFORMS & TOOLS’

From their website, Forex.com has MT5 and TradingView. This is not an exhaustive list because the broker has MT4 as well. You can look through each trading platform for more information about their features by clicking them.

Furthermore, some forex brokers also have their proprietary forex trading platforms. These platforms are developed by the company for the company. Traders hardly use these platforms for varying reasons. One of them is because of poor interface. However, brokers have greatly improved their platforms over the years with good trading conditions that may or may not be available on their third-party platforms

8. Account Base Currency

Another factor to consider is the Base Currency of your Trading account.

Most of locally regulated forex brokers, like OANDA and CMC Markets for example, have CAD base currency options. This is important if you are depositing your funds in the Canadian Dollar, as there will be no currency conversion fees.

Conversion fees can be high, leading to an increase in your initial deposit. To avoid this, you have to be verify that your broker has a Canadian Dollar account. Your broker should also allow deposit and withdrawals in CAD. This way, conversion fees are eliminated totally.

9. Losing Traders Data

Because forex brokers are regulated in different regions, the rules they have to follow are not always the same. In Canada, forex brokers are only required to let you know that your capital is at risk if you trade CFDs.

However, if your broker is regulated with both CIRO and the FCA, you can get a more detailed risk disclosure. This is because the FCA requires brokers in the UK to reveal the percentage of retail traders that lose money trading CFDs with them. Also, they are required to update this data so traders can only see recent data.

So if your broker is regulated in the UK. All you need to do is go to the UK version of their website to know how likely you are to lose your money. The data is usually at the header of their websites. You can use this data to decide if you should sign up with a broker or not.

10. Other trading Conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. Choosing a broker that offers negative balance protection prevents you from experiencing this.

If your chosen broker is regulated with the CIRO, you can be sure that they offer negative balance protection. Can you see why trading with a regulated broker is important?. You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on AvaTrade’s website

Finally, forex brokers are not mandated to provide negative balance protection if you are a professional trader. However, retail traders are guaranteed to get it.

c. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs.

Finding a broker’s education is easy. It is usually on their homepage. With few clicks, you can access quality courses for your learning. Let us show you how you can do this (AvaTrade is our example). On AvaTrade’s homepage, click on ‘Education’. Here is an illustration below.

With AvaTrade, you can see that there are 7 different learning sections available. To access each one, you only need to click them. For example, if you click ‘Trading for Beginners’, here is what you will see

You can see that AvaTrade’s ‘Trading for Beginners’ covers intermediate and advanced concepts of trading as well. This is how you find the wealth of knowledge available on your broker’s website.

How to Verify a Forex Broker’s CIRO Regulation?

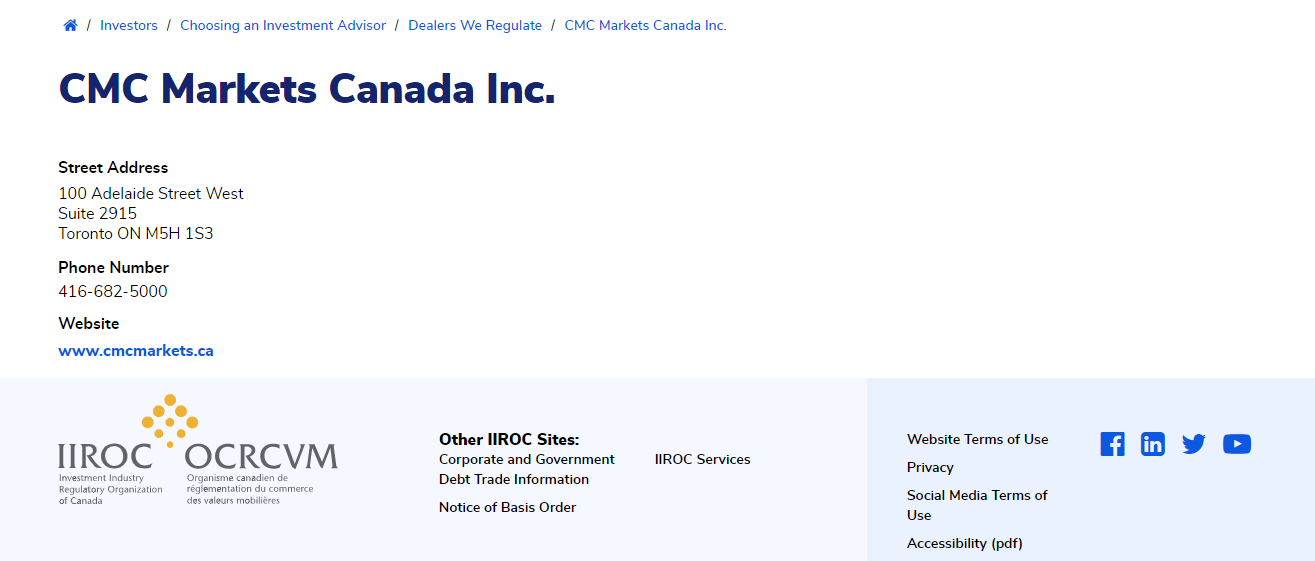

For this guide, we will use ‘CMC Markets’ as an example. These steps to verify a CFD broker’s licence in Canada would generally be the same for most forex brokers, and if the broker is regulated, then you can follow these general steps to verify the broker on CIRO.

So follow along.

1) Go to the website of the broker. In this example, we will go to cmcmarkets.com/en-ca (which is CMC Market’s local version website for Canada-based clients).

Scroll down to the end of the page & you will see their regulatory statement at the footnote. Here is a picture below showing their Canadian address and regulation statement.

2) The next step is to go to www.iiroc.ca/investors/dealers-we-regulate. When the page loads, enter the company’s name in the search bar as shown here.

3) Click the search icon. You should find CMC Markets’ details on the website as shown below. The information includes the Address of the broker, website & phone number.

You can see how the address on CIRO and CMC Markets’ websites matches. This is how you can verify a forex broker’s CIRO regulation.

Check the broker’s website that is approved to avoid any clones. Some fake brokers claim to be licensed by copying the websites of regulated brokers. You must be vigilant to avoid such scam brokers.

Do I need a broker for Forex Trading in Canada?

Yes, you need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the interbank market where currencies are actually traded.

Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market.

Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders. For example, on the backend, the access different providers to get the prices.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counterparty.

All of this happens in real time within a few micro seconds. Without a broker, retail or professional traders cannot trade currencies directly.

FAQs on Best Forex Brokers in Canada

What is CIRO Regulation?

The CIRO is short for Canadian Investment Regulatory Organization. They are a self‑regulatory organization & all the forex & CFD brokers in Canada must be regulated by them to ensure that they are legal.

How can I avoid fake brokers in Canada?

The only way to avoid fake forex brokers is to verify your chosen broker’s regulation with the CIRO. Avoid any brokers that are unlicensed. Make sure to verify from CIRO’s search to verify that the broker is legitimate.

Which is the best forex broker in Canada?

There is no one best broker for all traders. The best forex broker depends on your individual requirements. However, a broker that is regulated should be good for you. And after you have found a few regulated brokers, you should compare them based on fees, platforms, withdrawals, account types & other factors depending on your requirements.

Which forex broker has the best range of instruments?

According to our review, CMC Markets have the widest product range with over 10,000 CFDs available for trading on their platforms. But if you only want to trade forex & few other major CFDs, then most brokers offer them.

Do forex traders pay tax in Canada?

Money made or lost in forex trading is considered a capital gain or loss in Canada. However, you are only required to report a net gain or loss for the year that is more than CAD 200

How do I start trading forex in Canada?

You can start trading CFDs in Canada by taking the following steps:

1. Find a good phone (Android or iOS) or a desktop.

2. Find an CIRO regulated forex broker

3. Sign up and open a trading account

4. Complete your KYC by submitting relevant documents

5. Deposit your funds

6. Start trading